BetterFi’s Free Income Tax Prep

Volunteer Income Tax Assistance (VITA) Program

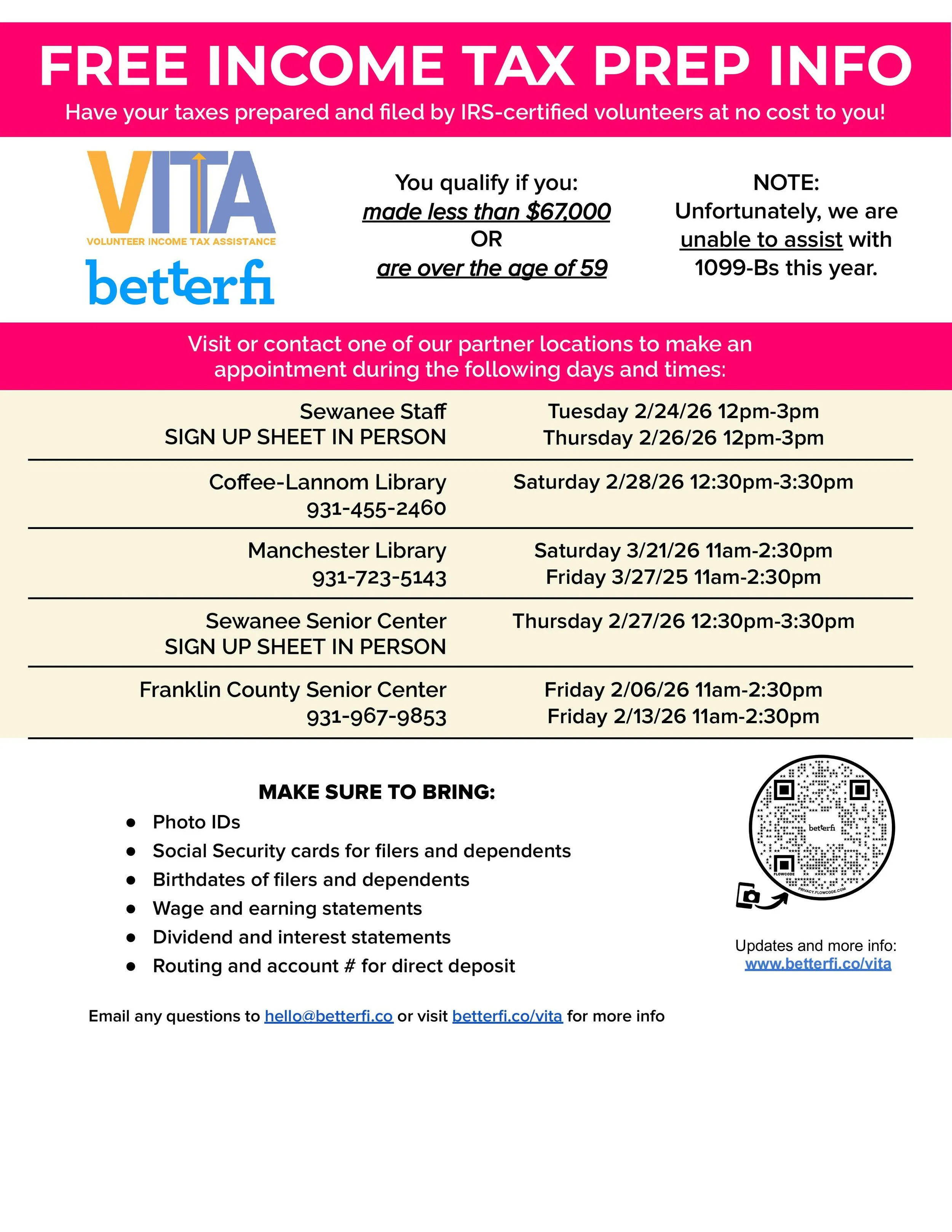

Please note we will be UNABLE TO ASSIST with any 1099-Bs this year.

BetterFi, with assistance from students of the University of the South and the IRS provides free tax assistance to nearby residents whose households make under $70,000 per year, are disabled, or are over 65.

You can find our current schedule on the flyer shown on this page. Please watch this space and our Facebook page (fb.com/betterfi) to keep up with announcements and the schedule.

Each location is keeping a list of appointments, so please contact or visit the location on the flyer to book one of the time slots.

Please review required documents below before arrival.

This year we will have Monday and Thursday time slots at our office in Grundy County during February by appointment only. We will look at March and April availability soon.

Please use the calendar below to schedule an appointment or call us at 931 313 9942 to inquire about availability.

SCHEDULE

| Location | Contact | Date & Time |

|---|---|---|

| Franklin County Senior Center | 931-967-9853 | Friday 2/6/26 11am-2:30pm & Friday 2/13/26 11am-2:30pm |

| Coffee-Lannom Library | 931-455-2460 | Saturday 2/28/26 11am-2:30pm & TBD |

| Manchester Library | 931-723-5143 | Saturday 3/21/26 11am-2:30pm & Friday 3/27/26 – 11am-2:30pm |

| Sewanee Senior Center | SIGN UP SHEET IN PERSON -open most lunches | Friday 2/27/26 12:30pm-3:30pm |

| Sewanee Staff - Social Lodge | SIGN UP SHEET IN PERSON | Tuesday 2/24/26 12pm-3pm & Thursday 2/26/26 12pm-3pm |

Tax Sites Nearby

Hamilton County

Bedford, Cannon, Coffee, Lincoln, Warren Counties

Marion County

Online

Want to make an appointment at our office in Grundy? Click HERE.

REQUIRED DOCUMENTS

Each resident filing with the Volunteer Income Tax Assistance program MUST bring the following:

Proof of identification (a photo ID)

Social security cards (if filing jointly, BOTH cards for BOTH individuals must be present)

Wage and earning statements (W-2, 1099, etc.)

Dividend and interest statements (if this applies to the resident filing)

Birth dates of the resident(s) and dependent(s)

A banking account and routing numbers for direct deposit of a refund (found on a blank check)

If a resident filing does NOT have a social security card, then he/she must bring an IRS Individual Taxpayer Identification Number (ITIN) assignment letter.

Unfortunately, this year we will not be able to help filers with a 1099-B.

Grundy County Appointments

Sign up for an appointment using the calendar on this page.

Grundy County appointments are available most Mondays and Thursdays during February at our office in Coalmont but must be booked at least 48 hours in advance.

Address for Grundy Appointments

BetterFi

9933 State Route 56

Coalmont, TN 37313

Please review the REQUIRED DOCUMENTS above.

Call us at 931 - 313 - 9942, email us hello@betterfi.co, or use the Contact Us page if you cannot make any of the available appointment times and we will try to accommodate you.